The Solar Investment Tax Credit

The Residential Clean Energy Credit, also known as the Solar Investment Tax Credit, is a renewable energy incentive program that has offers tax deduction incentives for homeowners who choose solar energy. Residential solar energy has rapidly grown and continues to become more widely available to homeowners, especially in Florida.

“The ITC allows homeowners and business owners who have purchased and installed solar photovoltaic (PV) energy generation systems in 2022 or will do so before 2033 to claim a federal tax credit equal to 30% of the overall cost of the system’s components, installation and associated fees during the year of installation. A tax credit is a one-for-one dollar amount reduction from income tax that you would have paid without the credit. If your solar system costs $20,000 and you claim the ITC at 30%, you will owe $6,000 less in income tax for the year, lowering the system’s total cost to $14,000. As the new law currently stands, if the amount of tax you owe for the year you become eligible is less than the credited amount, you can roll the difference over to the following year.”

The Solar Tax Credit has been increased and extended for another 10 years. The ITC raised the amount of credit you can apply towards your income tax, from 26% to 30% of the overall cost of solar equipment. Instead of decreasing next year as scheduled, it extends until 2032. It will be reduced to 26% again in 2033, and then 22% in 2032.

This is great news because it means more savings for those who are ready to make the switch to solar.

Eligibility

“To be eligible for the Solar Tax Investment Credit, you will need to meet the following criteria. Consult your tax accountant to ensure your eligibility.

- The PV system is an original, new installation or is operational for the first time.

- You own the system outright or have financed the parts and installation with a loan.

- You aren’t leasing the system or paying anyone for the energy created by the system.

- You’re claiming the credit based on the cost of the PV system, its components, installation and fees.

If you meet the eligibility requirements to receive the Solar Tax Credit, you’ll need to complete and include Form 5695 with your federal tax return for the tax period in which the PV system is first installed and made operational.”

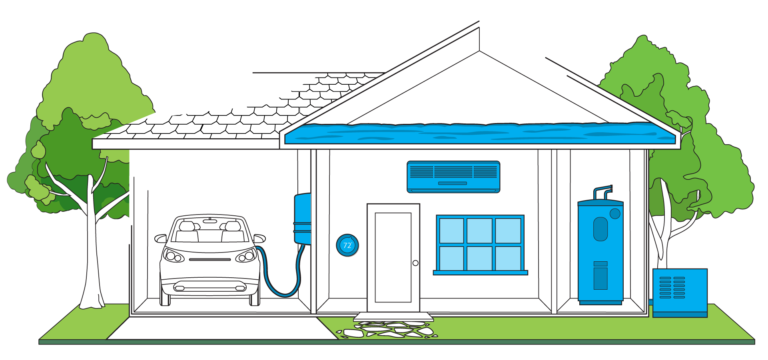

In addition, the tax credit allows you to receive deductions for up to 30% of the cost of other energy efficient features. Eligible items include heating, cooling, and water heating equipment, insulation materials, windows and exterior doors, and home energy audits. These items can add up to $5,050 in additional tax credit. Ecosun Homes builds solar-powered homes that include many of these features so our homeowners can feel good about using clean energy.

The EcoSun Advantage

Switching to solar can provide many more benefits than just a tax credit. With modern technology, solar energy is overall less expensive and more efficient than ever. Reducing the use of nonrenewable energy sources as well as reducing your overall energy bill. All Ecosun Homes contain solar panels for efficient energy use. Our homes undergo rigorous testing to meet Department of Energy standards, allowing homeowners to take advantage of this tax credit. Ecosun Homes is dedicated to making a difference with our DOE certified Zero Energy Ready homes, thoughtfully designed to integrate the best green technology with premium smart home features.

With Ecosun, the future is always bright.

Source:

https://www.forbes.com/home-improvement/solar/solar-tax-credit-extension-2023/