According to data from the National Association of Home Builders, the number of tax returns claiming energy-efficient tax credits has risen significantly in recent years. This increase is due in part to more new homes being built to higher energy-efficient standards, which allows homebuyers to claim the tax credits. The tax credits are available for items such as solar panels, windows, insulation, and heating and cooling systems that meet certain energy efficiency criteria.

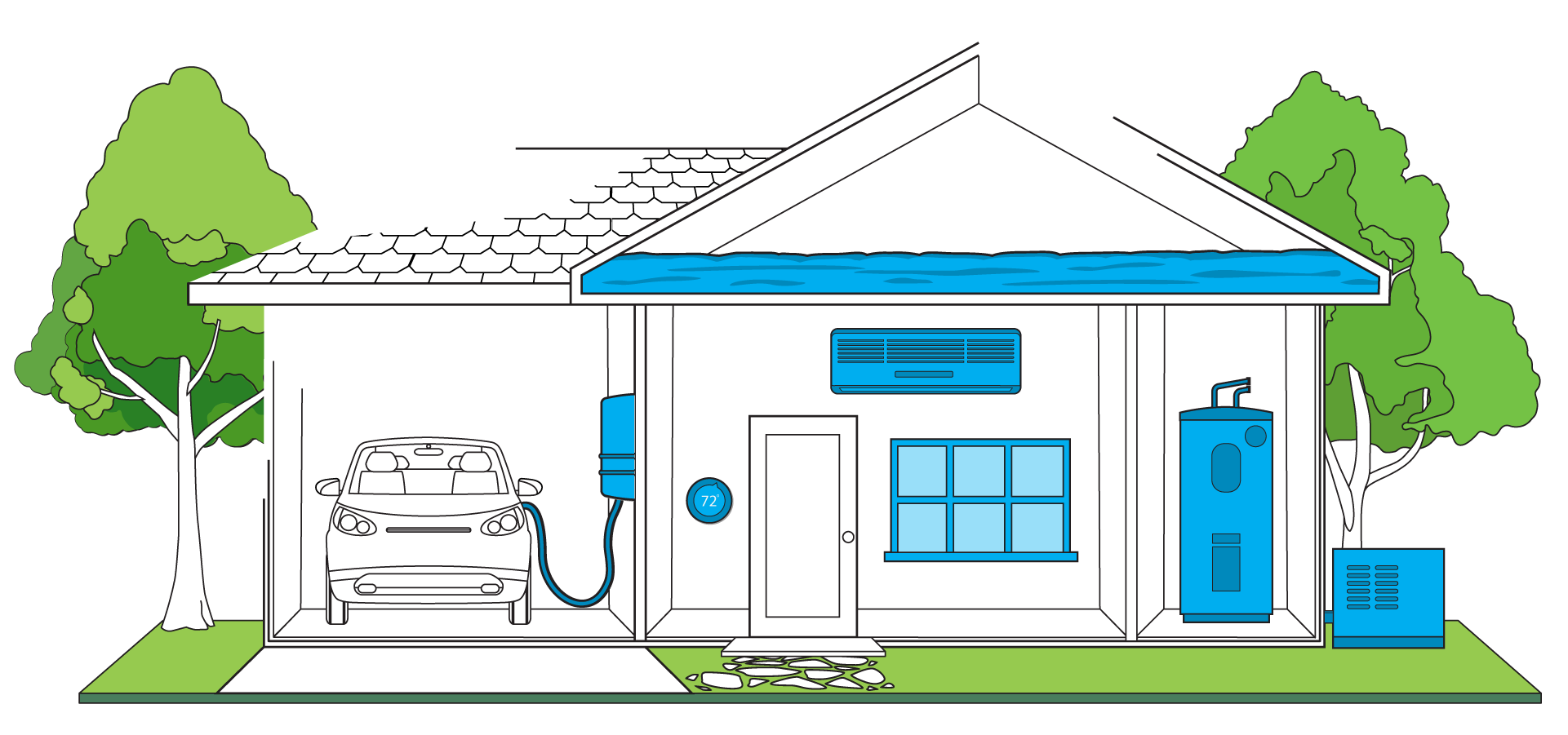

EcoSun homes makes it easy for new homeowners to take full advantage of the energy tax credits. All of our homes come standard with solar panels and energy efficient lighting, appliances, and insulation to make sure your home produces more energy than it needs, allowing you to save on electricity bills AND claim tax credits.

“A recent Internal Revenue Service data analysis by the National Association of Home Builders (NAHB) indicates that more than 800,000 taxpayers claimed a new home-related energy-efficiency tax incentive. NAHB found that the most claimed qualifying activity for the 25D credit in 2020 was the installation of solar electric property. More than 600,000 taxpayers claimed the credit for almost $12.6 billion in qualifying installation costs. The second most common installation in 2020 was for solar water heating, which was claimed by 114,000 home owners and totaled almost $627 million in installation costs.”

The solar industry continues to grow, as well as the tax incentives for new homeowners.

Here at EcoSun, we look forward to building a brighter future for generations to come. We are committed to making a positive impact on the environment while also doing our part to make homes more affordable. Call today to learn more about how you can save on your new home and claim energy tax credits!

Source: https://www.nahb.org/news-and-economics/press-releases/2023/04/new-home-buyers-increasingly-claim-energy-efficient-tax-credits